Loan Origination Architecture & Capabilities

Application Intake & Workflow Automation

As part of our custom software development services, we build loan origination systems that automate application submission, document collection, borrower profiling, and eligibility validation. The platform streamlines workflows from initial request to credit decision.

Credit Assessment & Underwriting Engine

Our systems integrate rule-based logic and AI-driven risk models to evaluate creditworthiness, verify financial data, and accelerate underwriting decisions with higher accuracy.

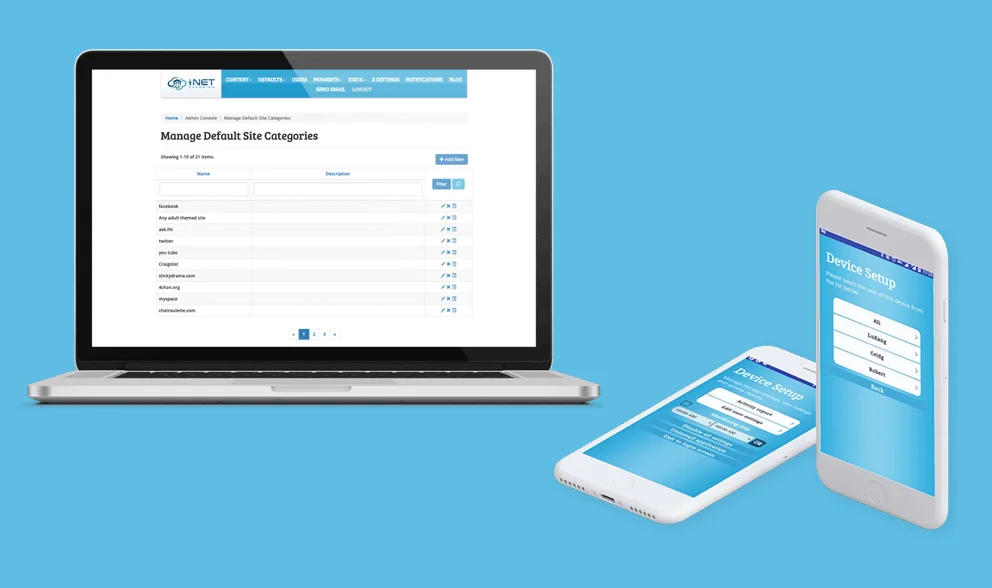

Document Management & Verification

The platform supports secure document uploads, automated data extraction, identity verification, and compliance checks to reduce manual processing and errors.

Compliance & Audit Controls

We incorporate regulatory workflows, audit trails, approval hierarchies, and reporting modules to ensure alignment with financial regulations and internal policies.

Third-Party Integrations

The system connects with credit bureaus, banking APIs, KYC providers, and payment services to enable seamless data exchange and decision automation.

Scalable & Secure Infrastructure

Built on resilient cloud architecture, the loan origination system supports high availability, encryption standards, monitoring, and performance optimization for growing lending operations.